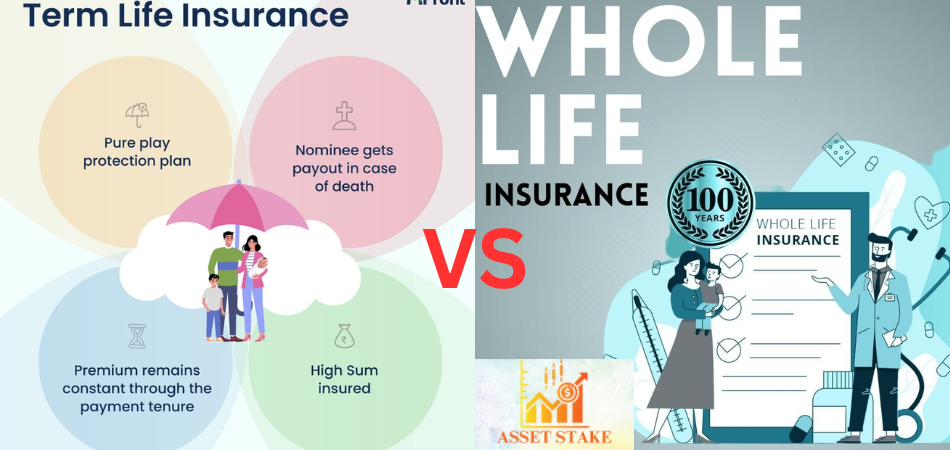

Term life insurance Vs whole life insurance are two primary types of life insurance policies, each with distinct features and benefits.

Term Life Insurance: Term life insurance is a contract between a policy holder and the insurance company. If the policy holder dies during the term policy period, the insurance company will pay the full policy amount. If the policyholder outlives the term and doesn’t renew or convert the policy, the coverage ends, and no benefits are paid.

Whole Life Insurance: Whole life insurance is a permanent life insurance which provides coverage for entire lifetime, as long as premiums are paid. It combines a death benefit with a cash value component, making it both a protection tool and a potential financial asset.

1. Term Life Insurance Vs Whole Life Insurance Purpose

A. Term Life Insurance Purpose

The primary purpose of term life insurance is to provide financial protection for your loved ones or dependents in case you pass away during the policy term. It is designed to cover specific financial obligations and goals that are time-sensitive. Ensures your family or dependents can maintain their standard of living by replacing lost income after your death. Particularly important if you are the primary or sole breadwinner.

Covers outstanding debts such as a mortgage, car loan, student loans, or credit card balances, so your family doesn’t inherit financial burdens.

B. Whole Life Insurance Purpose

The primary purpose of whole life insurance is to provide lifetime financial protection with additional benefits beyond just a death benefit. It is designed for individuals who seek both lifelong coverage and a financial tool that can accumulate cash value over time. Ensures that your beneficiaries receive a guaranteed death benefit whenever you pass away, as long as premiums are paid. Offers peace of mind knowing your loved ones are financially protected for your entire life.

Helps with estate preservation and wealth transfer to heirs. Can be used to pay estate taxes, ensuring your assets are passed on without financial burden to your family.

2. Term Life Insurance Vs Whole Life Insurance Premium

A. Term life insurance premium

Term life insurance premiums are the regular payments which affordable term. These premiums are typically much lower than other types of life insurance, like whole life, making term life insurance an affordable option for many individuals. Younger individuals pay lower premiums because they are statistically less likely to die during the policy term.

Healthier individuals, with no major medical issues, qualify for lower rates.

B. Whole life insurance premium

Whole life insurance premiums are regular payments made to keep the policy active. These premiums are higher than those for term life insurance because whole life insurance provides both lifelong coverage and a cash value component. Here’s an overview of how they work. The premiums are level, meaning they stay the same throughout the life of the policy. This offers predictability and stability for long-term planning.

Whole life insurance premiums are significantly higher than term life insurance because part of the payment goes toward building cash value. You pay premiums for as long as you want the policy to remain active unless you purchase a paid-up policy (which stops requiring payments after a set time).

3. Term Life Insurance Vs Whole Life Insurance Cash Value

A. Term life insurance cash value

Unlike whole life insurance or other permanent life insurance policies, term life insurance is designed solely to provide a death benefit to your beneficiaries if you pass away during the term of the policy. All of your premiums go toward the cost of the death benefit and administrative fees, not into a savings or investment component. Term life insurance is not designed to accumulate cash value; its primary purpose is affordable, temporary financial protection.

B. Whole life insurance cash value

Whole life insurance includes a cash value component, which is one of its defining features. This cash value provides policyholders with a savings or investment element in addition to the death benefit. A portion of your premium goes toward building cash value, while the rest covers the cost of insurance and administrative fees.

The cash value grows over time at a guaranteed rate, and the growth is typically tax-deferred, meaning you don’t pay taxes on the gains as long as they remain in the policy. Policyholders can access the cash value during their lifetime through loans, withdrawals, or surrendering the policy.

4. Term Life Insurance Vs Whole Life Insurance Duration

A. Term life insurance duration

The duration of a term life insurance policy refers to the length of time the policy provides coverage. Term life insurance is designed to offer protection for a specified period, which is why it’s called “term” life insurance. Typical Terms- 10, 15, 20, 25, or 30 years and Custom Terms- Some insurers offer customizable durations, such as 18 or 22 years, to match specific financial goals. A one-year term policy that can be renewed annually, with premiums increasing each year based on your age.

B. Whole life insurance duration

The duration of whole life insurance is one of its key features it provides coverage for your entire life as long as premiums are paid. Whole life insurance is designed to last for the insured’s entire life, regardless of how long they live. The policy guarantees a death benefit payout to beneficiaries, provided the premiums are kept up to date.

5. Term Life Insurance Vs Whole Life Insurance Coverage

A. Term life insurance coverage

Term life insurance provides a fixed amount of financial protection, known as the death benefit, for a specified period. This coverage is straightforward and designed to meet temporary financial needs. The coverage amount is the sum paid to your beneficiaries if you pass away during the policy term. Common coverage amounts range from $50,000 to $1,000,000 or more, depending on your needs and insurer limits. The amount is selected when you purchase the policy and remains fixed throughout the term.

B. Whole life insurance coverage

Whole life insurance offers lifelong coverage with additional features, such as a cash value component. The coverage lasts for the policyholder’s entire life, as long as premiums are paid. Whole life insurance provides coverage for your entire life, unlike term life insurance, which expires after a set period.

The policy pays a death benefit to your beneficiaries upon your passing, regardless of when that occurs, as long as premiums are paid. This amount is typically fixed and determined when you purchase the policy. It can range from tens of thousands to several million dollars, depending on your needs and financial situation.

6. Term Life Insurance Vs Whole Life Insurance Flexibility

A. Term Life insurance flexibility

Term life insurance is generally more rigid compared to permanent life insurance policies, but it still offers some flexible options that can suit a variety of needs. Term life insurance allows you to select the duration of the policy, typically ranging from 10 to 30 years. You can choose a term length that matches your financial obligations, such as covering a mortgage or supporting children until they are financially independent. Shorter terms (e.g., 10 years) offer lower premiums, while longer terms (e.g., 30 years) offer extended coverage but may come at higher premiums.

B. Whole life insurance flexibility

Whole life insurance is a permanent form of life insurance that provides lifelong coverage and includes a cash value component. While it is less flexible than term life insurance in some ways, it still offers certain flexible features that can adapt to your long-term financial goals.

Whole life insurance provides coverage for your entire life, as long as premiums are paid, so there’s no need to worry about outliving your policy or renewing coverage. Unlike term life insurance, which expires after a certain number of years, whole life insurance offers peace of mind with permanent protection.

Which one choose Term Life Insurance Vs Whole Life Insurance

Choosing between term life insurance and whole life insurance depends on your financial goals, budget, and the type of coverage you need. When you choose insurance policy then analysis few point such as purpose, premium, duration, cash value, coverage and flexibility. Every point analysis here then choose policy.