Mutual funds Vs ETF (Exchange-Traded Funds) are both investment vehicles that allow you to diversify your portfolio by pooling money from multiple investors to invest in a variety of assets like stocks, bonds, or other securities. However, they have key differences in structure, management, and trading.

Mutual Funds: Mutual Fund is important to have information about mutual funds such as how many types of mutual funds and how to choose the right mutual fund. What are the benefits and risks of mutual funds, investment modes like SIP, SWP, STP and what are the financial goals. Detailed information of mutual funds is given here, learn and invest in any fund. Professional fund managers operate the fund, aiming to generate returns for investors based on the fund’s stated objectives.

ETF (Exchange- Traded Funds): ETFs (Exchange-Traded Funds) are incredibly popular because of their flexibility, low costs, and tax efficiency. ETFs track a wide range of assets, including stock indices (e.g., S&P 500), sectors (e.g., technology or healthcare), commodities (e.g., gold or oil), bonds, and even international markets.

Mutual Funds Vs ETF Difference

1. Mutual Fund Vs ETF Management Difference

A. Mutual Funds Management Difference

Managing a mutual fund involves overseeing an investment pool where investors contribute money to achieve specific financial goals. Every mutual fund has a stated objective, such as growth, income, or a balance of both. The management team ensures that the fund adheres to this objective. For example: Equity Funds focus on stocks, Debt Funds invest in bonds or fixed-income securities, Hybrid Funds mix equity and debt.

B. ETF Management Difference

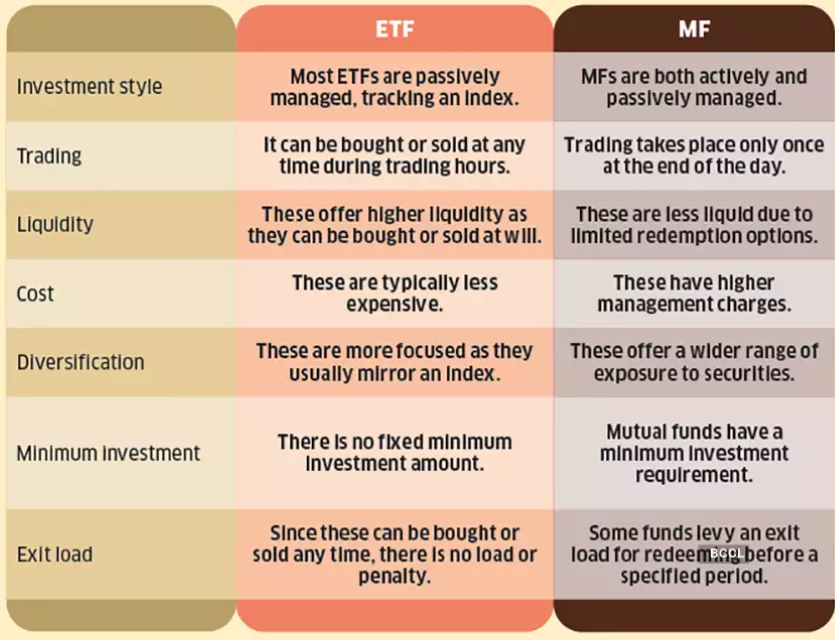

Managing an Exchange-Traded Fund (ETF) involves several similar principles to mutual fund management but also includes unique considerations due to the structure and trading mechanism of ETFs. ETFs are designed to track a specific index, sector, commodity, or asset class. The management ensures that the ETF closely mirrors its benchmark’s performance.

Most ETFs are passively managed, meaning the portfolio is adjusted to replicate the benchmark index’s composition. Ensuring the ETF’s returns closely match its benchmark index by addressing factors like:

2. Mutual Funds Vs ETF Minimum Investment Difference

A. Mutual Funds Minimum Investment

Mutual Funds Minimum Investment In U.S.

The minimum investment in mutual funds in the U.S. varies based on the fund provider and type of fund. Some mutual funds have no minimum, while others require a higher initial investment.

Traditional Mutual Funds: Typically require a minimum of $500 to $3,000.

No-Minimum Mutual Funds: Some funds, especially at Fidelity and Schwab, have $0 minimum if you invest through their platforms.

Automatic Investment Plans (AIP): Some funds lower the minimum if you set up recurring investments.

B. ETF Minimum Investment

In the U.S., the minimum investment in an ETF depends on the price of a single unit (share) of the ETF. There is no fixed minimum investment for ETFs. You need to buy at least one share at its market price. Some brokers allow fractional shares, meaning you can invest with as little as $1 in certain ETFs.

3. Mutual Funds Vs ETF Flexibility Difference

A. Mutual Funds Flexibility

Mutual funds offer various levels of flexibility depending on the type of fund and how you invest.

1. Flexibility in Investment Amount

Lump Sum or SIP – Invest a large amount at once or through Systematic Investment Plans (SIP), typically starting at $100 (India) or $0 (U.S.).

No-Minimum Funds – Some funds (e.g., Fidelity, Schwab, some Vanguard ETFs) have $0 minimums.

2. Portfolio Flexibility & Switching

Fund Switching – You can shift between funds within the same AMC (called STP – Systematic Transfer Plan in India).

Rebalancing & Asset Allocation – Many mutual funds offer auto-rebalancing based on market conditions.

3. Liquidity & Redemption Flexibility

Easy Redemption – Open-ended mutual funds allow you to buy/sell anytime (except ELSS or closed-end funds).

B. ETF Flexibility

ETFs offer high flexibility compared to mutual funds in terms of trading, cost, and tax efficiency. Here’s a breakdown of their key flexible features:

1. Investment Flexibility

No Minimum Investment – Buy just 1 share, or even fractional shares with brokers like Robinhood, Fidelity, and Schwab.

Variety of Assets – ETFs cover stocks, bonds, commodities, real estate, and international markets.

Sector & Thematic Investing – Easily invest in specific industries like tech, healthcare, or clean energy.

2. Trading Flexibility

Real-Time Trading – Buy and sell throughout the day like stocks.

Limit Orders & Stop-Loss – Unlike mutual funds, ETFs allow limit orders, stop-loss, and margin trading.

Short Selling – Some ETFs allow short-selling and options trading..

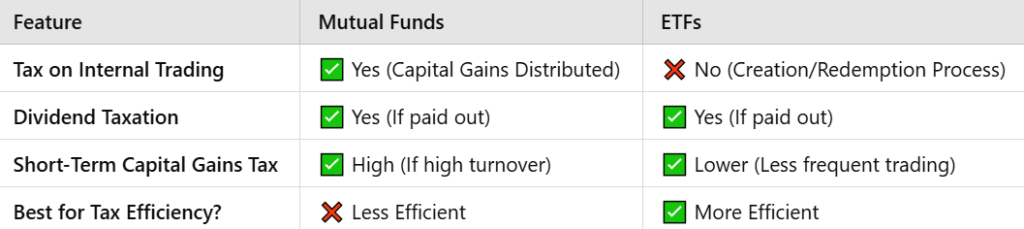

4. Mutual Funds Vs ETF Tax Efficiency Difference

A. Mutual Funds Tax Efficiency Difference

Mutual funds vary in tax efficiency based on their structure, investment strategy, and how they distribute gains.

1. Capital Gains Tax on Mutual Funds

If the fund manager sells securities inside the fund, you may owe capital gains tax, even if you don’t sell your shares.

Types of capital gains

Short-Term Capital Gains (STCG) – If you sell within 1 year → Higher tax rate (same as income tax rate in the U.S. and 15% in India).

Long-Term Capital Gains (LTCG) – If you sell after 1 year (U.S.) or 3 years (India, for debt funds) → Lower tax rate (0-20%).

2. Dividend Tax on Mutual Funds

U.S.: Dividends are taxed at either ordinary income rates or lower “qualified dividend” rates (if held for more than 60 days).

India: Dividends are added to total taxable income and taxed as per your slab.

B. ETF Tax Efficiency

ETFs are more tax-efficient than mutual funds due to their unique structure and trading process.

1. Why Are ETFs More Tax-Efficient?

Unlike mutual funds, ETFs minimize taxable events through their creation/redemption process:

No forced capital gains distributions – ETFs don’t have to sell holdings to meet redemptions like mutual funds.

In-Kind Transactions – ETFs use authorized participants (APs) to swap securities instead of selling them, reducing taxable capital gains.

Lower Turnover – Many ETFs track indexes, leading to fewer transactions and lower tax liability.

2. Capital Gains Tax on ETFs

Short-Term Capital Gains (STCG): If sold within 1 year, taxed as ordinary income (higher tax rate).

Long-Term Capital Gains (LTCG): If sold after 1 year, taxed at lower rates (0%, 15%, or 20% in the U.S.).

3. Dividend Tax on ETFs

Qualified Dividends: Taxed at lower LTCG rates (0%, 15%, 20%).

Non-Qualified Dividends: Taxed as ordinary income (higher rate).

REIT & Bond ETFs: Often taxed at higher rates because they generate interest income.