As of February 2025, Tata Technologies share price was approx. ₹750.00. Recently, the National Stock Exchange (NSE) announced that Tata Technologies will be included in the Futures and Options (F&O) segment starting from the March series. This inclusion is expected to enhance liquidity and attract more investors to the stock which increase Tata technologies share price.

Analyst recommendations vary, with some suggesting a ‘Strong Buy’ and others advising ‘Sell’. The average 12-month price target is ₹884.55, indicating potential upside. In the latest quarter, Tata Technologies reported earnings per share (EPS) of ₹4.20, slightly above the forecasted ₹4.06.

Key Factors Influence TATA Technologies Share Price

1. Financial Performance influence TATA technologies share price

A. Revenue Growth

1. Impact: Consistent revenue growth, especially from new contracts or expansions in sectors like automotive or aerospace, signals demand and scalability. Positive revenue surprises often boost share prices.

2. Example: A major EV partnership announcement could drive investor optimism, lifting the stock.

B. Profitability Metrics

1. Earnings Per Share (EPS): Beating market expectations for EPS typically leads to share price appreciation, while misses can trigger sell-offs.

2. Margins: Improving gross, operating, or net margins reflect cost efficiency and pricing power, enhancing investor confidence.

C. Debt and Liquidity

1. Leverage: High debt levels may raise solvency concerns, especially in rising-rate environments. Deleveraging efforts can improve credit ratings and share valuations.

2. Liquidity Ratios: Strong current or quick ratios assure investors of short-term stability, reducing perceived risk.

D. Cash Flow

1. Operating Cash Flow: Positive cash flow enables reinvestment, dividends, or debt reduction. Sustained cash generation often correlates with share price resilience.

2. Free Cash Flow: High FCF supports shareholder returns (e.g., buybacks), attracting income-focused investors.

E. Valuation Ratios

P/E, P/S, EV/EBITDA: Earnings growth can lower P/E ratios, making shares appear undervalued. Sector-leading multiples may reflect strong growth expectations.

F. Dividend Policy

Dividend Yield: Increases in payouts signal financial health, appealing to income investors. Cuts or omissions may trigger negative sentiment.

2. Industry & Market Trend Influence TATA Technologies Share Price

Industry and market trends play a crucial role in influencing Tata Technologies share price. Here’s how different trends impact Tata technologies share price.

A. Growth in Engineering R&D and Digital Transformation

Tata Technologies operates in the engineering R&D (ER&D) services sector, which is seeing strong demand globally. Increased spending by automotive, aerospace, and industrial clients on digital transformation, automation, and cloud-based solutions benefits the company. Positive trend Boosts revenue and stock price.

B. Automotive & Electric Vehicle (EV) Sector Growth

Tata Technologies derives a significant portion of its revenue from the automotive industry, including Tata Motors. Rising EV adoption and investments in sustainable mobility create opportunities for the company. Government incentives and policies supporting EV production help its business grow. Positive trend Strong EV demand benefits Tata Technologies’ valuation.

C. Global Slowdowns & Recession Fears

Slowdowns in key markets like the US, Europe, and China can reduce engineering and technology spending by clients. High interest rates and inflation reduce corporate budgets for outsourcing engineering services, affecting revenue growth. Negative trend Economic downturns can put pressure on the stock price.

D. Competition from Other ER&D Players

Competitors like L&T Technology Services, KPIT Technologies, and global players like Accenture & Infosys influence market positioning. Strong competition can lead to pricing pressure, affecting margins and profits. Neutral to negative trend If Tata Technologies loses market share, the stock could underperform.

3. Business Development & Contracts Influence TATA Technologies Share Price

Business development and contract wins have a direct impact on Tata Technologies share price. Here’s key factors impact Tata technologies share price.

A. Large Deal Wins & Long-Term Contracts

Securing major contracts from global automotive, aerospace, or industrial clients boosts revenue visibility. Long-term deals indicate stable earnings growth, making the stock more attractive to investors.

Positive impact: Large contracts increase investor confidence and push the share price higher.

B. New Client Acquisitions & Expansion into New Markets

Expanding its client base across geographies (Europe, US, China) reduces dependency on specific markets. Entry into new industries like healthcare, defense, or renewables diversifies revenue streams.

Positive impact: New clients and market expansion increase growth potential, benefiting the stock.

C. Strategic Partnerships & Joint Ventures

Collaborations with tech firms, OEMs, or industrial players strengthen its capabilities.

Example: A partnership with an EV manufacturer for engineering solutions could drive demand for its services.

Positive impact: Strong alliances signal growth potential, attracting investors.

D. Mergers & Acquisitions (M&A)

Acquiring niche engineering or digital transformation firms enhances Tata Technologies’ service offerings. A well-executed acquisition can boost market share and expand its global footprint.

Positive impact (if strategic): Growth through acquisitions generally drives stock appreciation.

E. Dependency on Tata Motors & Key Clients

Tata Technologies derives a significant portion of revenue from Tata Motors and Jaguar Land Rover (JLR). If Tata Motors slows down or reduces outsourcing, it can hurt Tata Technologies’ earnings.

Negative impact: High dependency on a few key clients increases risk exposure.

F. Order Book Growth & Revenue Visibility

A strong pipeline of future contracts provides revenue stability, reducing stock volatility. Investors track the order book size to estimate future earnings potential.

Positive impact: Higher order inflow strengthens investor confidence.

4. Parents Company Influence Tata Technologies Share Price

Tata Technologies is a subsidiary of Tata Motors, and its share price is significantly influenced by its parent company and the broader Tata Group. Here’s key factors impact Tata technologies share price.

A. Revenue Dependency on Tata Motors & JLR

Tata Technologies earns a large portion of its revenue from Tata Motors and Jaguar Land Rover (JLR). If Tata Motors performs well, it increases demand for engineering R&D services, boosting Tata Technologies share price & revenue. Conversely, a slowdown in Tata Motors’ production or budget cuts in R&D can negatively impact Tata Technologies’ earnings.

B. Market Sentiment Around Tata Group Stocks

Tata Group is one of India’s most trusted business conglomerates. If Tata Group companies (like Tata Consultancy Services, Tata Power, Tata Steel) perform well, investor confidence in Tata Technologies increases. Negative news about any Tata Group firm can affect sentiment, leading to stock declines.

C. Business Strategy & Investments by Tata Motors

Tata Motors’ focus on electric vehicles (EVs), autonomous cars, and connected mobility increases the demand for Tata Technologies’ services. If Tata Motors reduces R&D spending or restructures, it may cut outsourcing contracts with Tata Technologies.

D. Tata Technologies’ Strategic Role in Tata Group’s Future Plans

Tata Technologies is a key player in engineering & digital transformation within the Tata ecosystem. If Tata Group uses Tata Technologies for internal technology initiatives, it ensures steady revenue. Expansion into non-Tata clients would reduce dependence on the parent company and improve stock performance.

E. Shareholding & Stake Sales by Tata Motors

Tata Motors holds a majority stake in Tata Technologies. If Tata Motors sells a stake to raise capital, it could increase the stock’s free float and attract more institutional investors. If Tata Motors reduces its holding significantly, it may raise concerns about the company’s strategic importance within the Tata Group.

F. Financial Health & Global Presence of Tata Motors

Strong profitability and global expansion of Tata Motors benefit Tata Technologies. If Tata Motors struggles with debt or operational issues, it may impact Tata Technologies’ growth prospects which Tata technologies share price.

5. Geopolitical Factors Influence Tata Technologies Share Price

Geopolitical events can significantly impact Tata Technologies share price, as it operates in global markets, especially in the automotive and engineering R&D sectors. Here’s how different geopolitical factors affect the Tata technologies share price.

A. Global Economic Slowdowns & Recession Risks

If key economies like the US, Europe, or China face a slowdown or recession, demand for engineering and R&D services could decline. Companies reduce outsourcing budgets during uncertain economic periods, impacting Tata Technologies’ revenue.

B. US-China Trade Tensions & Protectionist Policies

The US and China are key markets for Tata Technologies. Tariffs, trade barriers, or restrictions on technology exports can affect business operations. If the US enforces stricter outsourcing policies, Tata Technologies might lose potential contracts.

C. Geopolitical Conflicts (Russia-Ukraine, Middle East, etc.)

Wars and conflicts lead to global market volatility, affecting investor sentiment. Supply chain disruptions in automotive, aerospace, and industrial sectors can slow project execution for Tata Technologies that can decrease Tata technologies share price.

D. Currency Exchange Rate Fluctuations

Tata Technologies earns revenue in multiple currencies (USD, EUR, GBP, CNY, INR). A stronger Indian Rupee (INR) against USD reduces export earnings, impacting profits. A weaker INR makes Indian services more competitive globally, benefiting outsourcing demand.

6. IPO & Shareholding Structure Impact TATA Technologies Share Price

The IPO and shareholding structure of Tata Technologies significantly impact Tata technologies share price due to factors such as investor sentiment, demand-supply dynamics, and long-term business fundamentals. Here Key Factors Impact Tata technologies share price.

A. Impact of IPO on Tata Technologies Share Price

1. Pre-IPO Effects

Investor Interest & Hype: Since it was a highly anticipated IPO, strong demand led to a high listing premium.

Oversubscription: The IPO was oversubscribed 69.43 times, indicating massive demand.

Grey Market Premium (GMP): A high GMP before listing suggested strong post-listing performance.

2. Post-IPO Effects

Listing Gains: The stock listed at ₹1,200, a 140% premium over the IPO price of ₹500.

Volatility: Post-listing, the share price witnessed profit booking but remained stable due to strong fundamentals.

Lock-in Period Impact: Post-IPO, pre-IPO shareholders (promoters, employees, and anchor investors) have lock-in periods. Once these expire, potential selling pressure could impact the stock price.

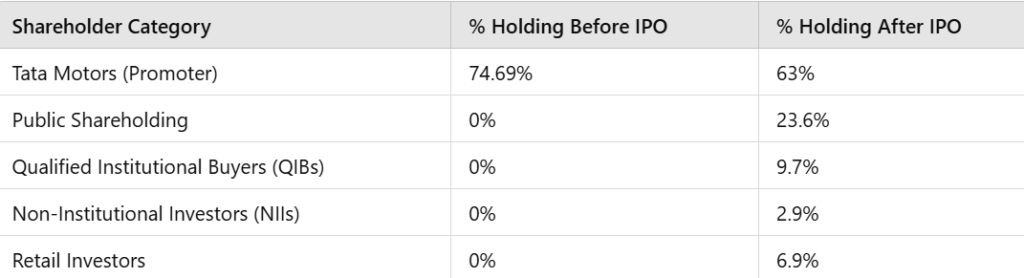

B. Shareholding Structure & Its Impact on Share Price

The shareholding pattern directly influences price stability and long-term growth.

Shareholding Impact on Tata technologies Share Price

Promoter Holding (63%): High promoter holding signals strong confidence in the business, a positive sign for investors.

Institutional Investors (9.7%): Presence of mutual funds & FIIs provides stability and long-term growth potential.

Public Holding (23.6%): A diverse retail base can lead to increased trading volume but also volatility.

Lock-in Expiry (Future Concern): When major investors (pre-IPO holders) exit post-lock-in, selling pressure may cause short-term price dips.

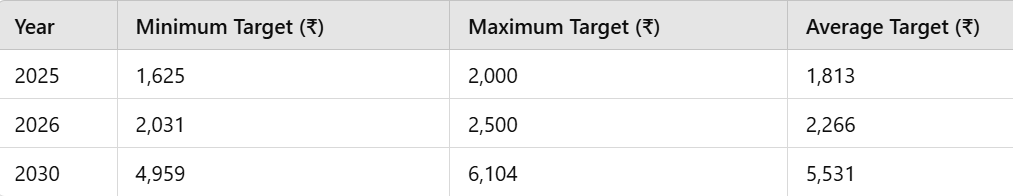

TATA Technologies Share Price Target

As of February 2025, Tata Technologies share price was approx. ₹733.85. Recent developments include the company’s inclusion in the Futures and Options (F&O) segment, effective from the March series, which has positively influenced investor sentiment.

Analyst projections for Tata Technologies share price target are as follows

These projections suggest a positive growth trajectory for Tata Technologies share price over the next decade. It’s essential to consider market volatility and take research analysis before making investment decisions of Tata technologies share price.

TATA Technologies Share Price History

TATA Technologies Limited (NSE: TATATECH, BSE: 544028) is a subsidiary of Tata Motors and was listed on Indian stock exchanges in November 2023. Below is a summary of Tata technologies share price history and key milestones since its IPO.

A. IPO and Listing Details

1. IPO Date: 22–24 November 2023

2. Listing Date: 30 November 2023

3. IPO Price Band: ₹475–500 per share

4. Listing Price: Opened at ₹1,200 (140% premium over IPO price)

5. Closing Price on Listing Day: ₹1,313 (up ~163% from IPO price)

B. Post-Listing Tata technologies share price history

1. November–December 2023: After a strong debut, the stock faced profit-booking and volatility. Corrected to ₹1,100–1,200 range by mid-December.

2. January 2024: Reached an all-time high of ₹1,400 (as of January 2024) due to bullish sentiment around Tata Group stocks and growth in engineering/R&D services.

3. February–March 2024: Consolidated between ₹1,100–1,300 amid broader market volatility and profit-taking.

4. April 2024: Stabilized around ₹1,150–1,250, influenced by quarterly results and sectoral trends.