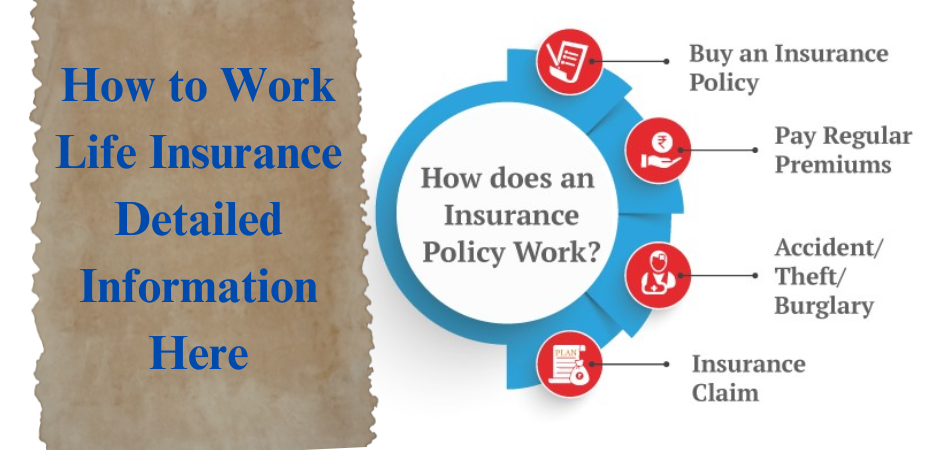

How does Life Insurance Work ? Life insurance is a financial product that provides a payout to designated beneficiaries upon the policyholder’s death or, in some cases, after a specified period. It’s designed to offer financial security to your loved ones by replacing income, covering debts, or funding long-term goals like education.

How does Life Insurance Work ? Step to Step Here

1. Choose a Life Insurance Policy

Choosing an insurance policy can seem overwhelming, but following a structured approach can help ensure you pick the right one for your needs.

A. Understand Your Insurance Needs

Determine the type of coverage you need:

Life Insurance: Protect loved ones financially in the event of your death.

Health Insurance: Cover medical expenses.

Auto Insurance: Protect against vehicle-related accidents or damages.

Homeowners/Renters Insurance: Cover property damage or personal belongings.

Disability Insurance: Provide income if you’re unable to work due to an illness or injury.

Identify your goals: Are you protecting dependents, covering debts, or preparing for unexpected events?

B. Choose the Right Type of Policy with budget

Term Life: Straightforward coverage for short time of period with affordable price.

Whole Life or Universal Life: Permanent coverage with investment components.

For health insurance: Evaluate plans based on premiums, deductibles, co-pays, and coverage networks.

Budget: Consider how much you can afford in premiums without straining your finances.

C. Compare Policies

Shop Around: Use comparison websites or work with an independent agent.

Focus on Key Features: Premium cost, Coverage limits, Exclusions and conditions

Flexibility (e.g., ability to adjust coverage or cash-out options)

Request detailed quotes from multiple providers.

D. Check the Insurance Provider

Reputation: Look for reviews and ratings from trusted organizations like A.M. Best, Moody’s, or J.D. Power.

Financial Stability: Financial stability is important for paying claim on time.

Customer Service: Assess their claim process, responsiveness, and ease of contact

2. Paying Life Insurance Premium

Paying premiums for a life insurance policy is essential to keep your coverage active. Here’s a guide to understand and manage life insurance premium payments effectively.

A. Understand Life Insurance Premiums

Premium Definition: The amount you pay regularly (monthly, quarterly, semi-annually, or annually) to maintain your policy.

Factors Influencing Premiums: Type of policy (term vs. permanent), Coverage amount (death benefit), Policy term or duration, Age, health, and lifestyle

B. Choose a Payment Frequency

Options: Monthly, quarterly, semi-annual, or annual.

Benefits of Annual Payment: Often cheaper due to discounts.

Easier to manage if you can budget for a single payment.

Benefits of Monthly Payment: More manageable for cash flow.

Convenient for those on a fixed monthly budget.

C. Payment Methods

Direct Debit/Automatic Bank Draft: Ensure timely payments and avoid policy lapses.

Online Payments: Pay via the insurer’s website or mobile app.

Credit/Debit Card: Convenient but watch for processing fees (if any).

Check or Money Order: Some insurers allow traditional paper payments.

Payroll Deduction: If offered by your employer, premiums are deducted directly from your paycheck.

D. Monitor Due Dates

Policy Schedule: Familiarize yourself with the payment schedule to avoid missing deadlines.

Grace Period: Most insurers provide a grace period (typically 30–60 days) to make a payment after the due date without losing coverage.

Late Fees or Penalties: Be aware of potential charges for late payments beyond the grace period.

E. Plan for Premium Increases

Level Premiums: Term policies usually have fixed premiums for the term duration.

Flexible Premiums: Permanent policies may allow adjustments but can increase over time depending on policy type and cash value.

Renewal Premiums: For term policies, premiums often rise significantly after the initial term if you renew.

3. Death Benefits, Life insurance Work

The death benefit is the amount of money paid to the beneficiaries of a life insurance policy when the policyholder passes away. It’s the primary purpose of life insurance, offering financial security to your loved ones after your death. Here’s what you need to know.

1. Definition of Death Benefit

A tax-free lump sum payment (in most cases) provided to the beneficiaries listed on the life insurance policy.

The payout can be used for various financial needs, such as paying off debts, replacing income, or funding future goals like education.

2. How Death Benefits Work

Trigger for Payment: The benefit is paid out when the policyholder dies, as long as the policy is active and all premiums are up to date.

Claim Process: Beneficiaries must notify the insurance company of the policyholder’s death.

Submit required documentation, such as a claim form, The death certificate, Identification or proof of beneficiary status

The insurance company reviews and processes the claim, typically within 30-60 days.

3. Types of Death Benefits

Fixed Amount: A specific amount determined at the time the policy is purchased (e.g., $500,000).

Increasing or Decreasing Amount: Some policies allow for benefits to grow over time (e.g., tied to inflation) and Others, like mortgage protection insurance, have decreasing benefits as the insured debt decreases.

Partial Payments: In certain cases, beneficiaries may receive a portion of the death benefit during the policyholder’s lifetime (e.g., if accelerated death benefit riders are triggered).

4. Life Insurance Policy Exclusions

Life insurance policies unnatural time have exclusions, which are specific circumstances under which the insurer will not pay the death benefit to the beneficiaries.

1. Suicide Clause: Most policies include a suicide exclusion period, typically 1-2 years after the policy starts.

If the policyholder dies by suicide within policy period, than insurer company only refund the premiums paid.

2. Death Due to Risky Activities: Some policies exclude deaths resulting from high-risk activities, such as, Skydiving, scuba diving, or rock climbing, Motor racing, Aviation (non-commercial flights or piloting a private plane). You may purchase additional coverage (a rider) for high-risk activities if needed.

3. Death Due to Illegal Activities: Deaths occurring while engaging in illegal acts, such as drug trafficking or committing a crime, are usually not covered.

4. War or Acts of Terrorism: Many policies exclude deaths caused by acts of war, terrorism, or military service in combat zones.

Special coverage may be available for military personnel through government or private programs.

5. Substance Abuse or Drug Overdose: If the policyholder’s death is directly caused by the use of illegal drugs or misuse of prescription drugs, the insurer may deny the claim.

Alcohol-related exclusions may also apply if the policyholder dies while driving under the influence.

6. Pre-Existing Medical Conditions: Some policies may exclude deaths related to pre-existing health conditions that were not disclosed during the application process.

Policies with simplified underwriting or guaranteed acceptance often have stricter exclusions related to health conditions.

7. Fraud or Misrepresentation: If the policyholder provides false or incomplete information during the application process (e.g., about health, lifestyle, or age), the insurer can deny the claim.

This typically falls under the contestability period (usually the first 1-2 years of the policy).

8. Homicide (Beneficiary Involvement): If the policyholder is murdered, and the beneficiary is found to be involved or suspected of foul play, the insurer will not pay the benefit to that beneficiary.

The benefit may be paid to contingent beneficiaries or the policyholder’s estate.

9. Death in a Restricted Country: Some policies exclude deaths occurring in countries deemed high-risk due to war, political instability, or lack of proper healthcare infrastructure.

Check the list of restricted countries with your insurer.

10. Participation in Hazardous Jobs: Deaths resulting from dangerous professions, such as Mining, Commercial fishing, Logging

Some insurers may charge higher premiums or exclude coverage for these risks unless additional coverage is purchased.

11. Natural Disasters: Certain policies exclude deaths caused by natural disasters like earthquakes or floods, though this is less common.

12. Experimental Treatments: Death resulting from unapproved medical treatments, experimental therapies, or participation in clinical trials may not be covered.

13. Waiting Periods: Some policies, especially guaranteed issue or simplified issue life insurance, have waiting periods (e.g., 2-3 years). If the policyholder dies during the waiting period, only the premiums paid (often with interest) will be refunded.

Benefits of Life Insurance All Benefits Information

Life insurance provides a range of benefits for individuals and their loved ones. Here are some key advantages.

1. Financial Security for Dependents: Company ensures financial support in the event of your untimely death and helps cover living expenses, debt repayment, education costs, and daily needs.

2. Income Replacement: Replaces lost income for your family, especially if you are the primary earner.

Provides a safety net to maintain their standard of living.

3. Debt Coverage: Pays off outstanding debts, such as mortgages, personal loans, or credit card balances.

Prevents family members from inheriting financial liabilities.

4. Estate Planning and Wealth Transfer: Facilitates the transfer of wealth to beneficiaries in a tax-efficient manner.

Helps avoid the burden of estate taxes or inheritance costs on your heirs.

5. Savings and Investment: Some policies (e.g., whole life or universal life insurance) offer cash value accumulation, acting as a savings or investment vehicle.

6. Peace of Mind: Reduces stress and anxiety by knowing your loved ones will be financially protected after your passing.

Allows you to focus on living life without worrying about future uncertainties.

7. Coverage for Final Expenses: Covers funeral, burial, and other end-of-life expenses, relieving your family of additional financial burdens.

8. Tax Advantages: Death benefits are generally tax-free for beneficiaries and some policies offer tax-deferred growth on cash value.

9. Flexibility and Customization: Policies can be tailored to meet specific needs, such as term insurance for temporary coverage or permanent insurance for lifelong protection.

How does Whole Life Insurance Work?

How to Work Whole Life Insurance ? Whole life insurance work is a life time work insurance that provides coverage for the insured’s entire lifetime, as long as premiums are paid.

1. How does Whole Life Insurance Works ?

A. Paying Premiums: Policyholders pay premiums regularly (monthly, quarterly, or annually) for the life of the policy

B. Cash Value Growth: The cash value grows over time at a guaranteed rate, with the potential for additional dividends depending on the insurer. The growth rate is typically conservative but steady.

C. Accessing Cash Value: You can borrow against the cash value, withdraw funds, or use it to pay premiums in the future. Loans taken from the cash value must be repaid with interest; otherwise, they reduce the death benefit.

Withdrawals may reduce the cash value and potentially the death benefit.

D. Death Benefit: When the clear passes away, the policy holder death benefit is paid to the beneficiaries. If loans or withdrawals were taken from the cash value, the payout might be reduced.

2. Advantages of Whole Life Insurance

A. Lifetime Protection: Coverage is not expire as long as premiums are paid.

B. Cash Value Component: Offers a savings element you can access for emergencies or retirement.

C. Tax Benefits: Cash value growth is tax-deferred, and death benefits are usually tax-free.

D. Fixed Costs: Predictable premiums help with financial planning.

How Does Term Life Insurance Work ?

How to Work Term Life Insurance ? Term life insurance is a type of life insurance that provides coverage for a specific period, If the policyholder death during the term, the company insurer pays a death benefit to the beneficiaries.

1. How Term Life Insurance Works

A. Selecting a Policy: Choose a term (e.g., 10, 20, or 30 years) based on your financial needs and life stage. Determine the coverage amount (death benefit) to meet your family’s financial obligations, such as mortgage, education, or daily expenses.

B. Paying Premiums: Pay regular premiums (monthly or annually) to keep the policy active.

C. If You Pass Away During the Term: Your beneficiaries receive the death benefit, which can be used for any purpose, such as paying off debts, replacing income, or covering living expenses.

D. If You Outlive the Term: The policy expires with no payout. Some insurers offer options to renew the policy, often at a higher premium, or convert it to a permanent policy.

2. Advantages of Term Life Insurance

A. Affordability: Lower premiums compared to permanent insurance.

B. Simplicity: Easy to understand and manage.

C. Customizable Coverage: Choose terms that align with financial milestones, such as paying off a mortgage or funding a child’s education.

D. Flexibility: Many policies allow for renewal or conversion to permanent insurance.

Who should Buy Life Insurance ?

1. Individuals with Dependents

Parents: To ensure that children are financially supported in case of untimely death.

Single Income Households: If one partner is the primary or sole earner, life insurance can replace the lost income.

2. Homeowners or Those with Debt: Life insurance can help pay off the mortgage, and preventing the family loss.

Student Loans or Other Debt: If co-signed loans exist, life insurance ensures the burden doesn’t fall on the co-signer.

3. Business Owners: Protect business partners by funding buy-sell agreements. Provide financial stability for the business after the owner’s death.

Cover outstanding business debts or liabilities.

4. High-Net-Worth Individuals: Use life insurance for estate planning to cover taxes and preserve the estate’s value for heirs.

Establish trust funds for beneficiaries

5. Stay-at-Home Parents: Even if they don’t earn an income, stay-at-home parents provide valuable services (e.g., childcare).

6. Young, Healthy Individuals: Lock in lower premiums by purchasing a policy early when health risks are minimal.

Protect future dependents if marriage or parenthood is expected.

7. Anyone Wanting to Cover Final Expenses: A small policy can cover funeral costs, cremation, or burial, ensuring that loved ones aren’t burdened with these expenses.