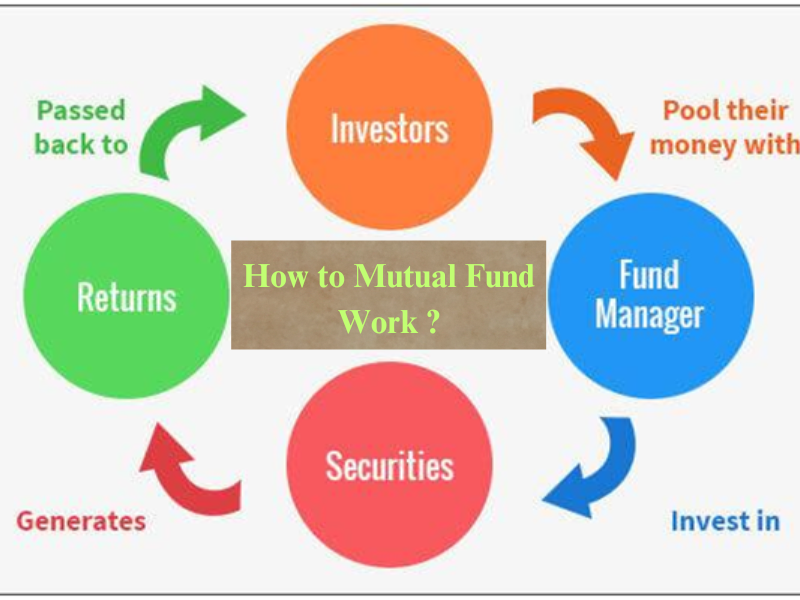

How to Mutual Fund Work ? A mutual fund is an investment type that collect money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, money market instruments, and other assets. Mutual fund managed by professional fund managers who allocate the fund’s assets to achieve specific investment goals.

Before address the "How to mutual fund work ?" let see at some important point in mutual fund.

1. Net Asset Value (NAV)

Net Asset Value (NAV) is a key metric in “How to mutual fund work” that represents the per-unit value of a mutual fund’s assets. It is calculated by taking the total value of the fund’s assets, subtracting its liabilities, and dividing the result by the total number of outstanding units or shares of the fund. NAV is used to determine the price at which investors can buy or sell mutual fund units.

How NAV Works is important role play “How to work mutual fund work ?”.

A. Purchase: When you buy units of a mutual fund, the purchase price is based on the NAV for that trading day (if purchased before the cut-off time).

B. Redemption: Similarly, when you sell or redeem your units, you receive the NAV of that day, adjusted for any applicable fees.

2. Asset Under Management (AUM)

AUM (Assets Under Management) is the total market value of all the investments that a mutual fund manages on behalf of its investors. It represents the size of the fund and is an important indicator of its scale, popularity, and market trust.

Why AUM is Important, because AUM is important component of “how to mutual fund work ?”.

A. Fund Size: A larger AUM indicates that the fund has attracted significant investor confidence.

B. Economies of Scale: Funds with larger AUM may benefit from lower expense ratios, as fixed costs are spread over a larger asset base.

C. Liquidity: Funds with high AUM often have better liquidity, enabling them to manage large redemptions without impacting the portfolio significantly.

3. Facesheet (Full information mutual fund working in sheet)

Facesheet in mutual funds is a concise document or summary provided to investors that contains essential information about a particular mutual fund scheme. It is designed to give a quick overview of the fund’s key details, helping investors make informed decisions. full working information “how to mutual fund work” available in sheet.

A. Quick Overview: Summarizes the most critical details for easy comparison between funds.

B. Transparency: Provides key data to help investors assess whether a fund aligns with their goals.

C. Compliance: Ensures mutual fund providers disclose essential information to investors.

4. Alpha

Alpha is a performance metric used in mutual fund work and other investment portfolios to measure the excess return generated by a fund relative to its benchmark index. It indicates the fund manager’s ability to add value beyond the market’s overall performance.

Why is Alpha Important in How to Mutual Fund work?

A. Measures Fund Manager’s Skill: A positive alpha suggests that the fund manager has successfully added value through active management.

B. Performance Assessment: Helps investors compare funds and identify those consistently outperforming their benchmarks.

C. Risk-Adjusted Performance: Takes into account both risk (beta) and returns, providing a balanced view of the fund’s effectiveness.

How to Mutual Fund Work ? Full detail analysis here step to step...

1. Pooling of fund by Investors

Funding of a pool by investors refers to the collective investment process where multiple individuals or entities contribute money to a common pool managed by a fund manager. This pooled capital is then invested in various assets, such as stocks, bonds, real estate, or other securities, based on the investment objectives of the fund.

A. How Funding of a Pool by Investors Works

1. Creation of the Fund: A fund is established with a defined investment strategy (e.g., equity fund, debt fund, real estate fund).

2. Contributions by Investors: Investors purchase “units” or “shares” in the fund by contributing capital.

Each unit represents a proportional ownership in the pool of assets.

3. Pooling of Capital: The money from all investors is combined into a single pool. This pooled capital provides the fund with significant resources to invest in diversified portfolios.

4. Investment Allocation: The fund manager uses the pooled capital to invest in a range of assets aligned with the fund’s goals.

Diversification helps reduce individual investor risk.

5. Earnings Distribution: Any profits generated from the investments (e.g., dividends, interest, capital gains) are either reinvested into the fund or distributed to investors based on their proportional ownership.

B. Advantages of Pooling Funds by Investors

1. Diversification: Pooled funds enable investments in a wide range of assets, reducing the risk of concentration in a single investment.

2. Professional Management Work: Fund managers handle investment decisions, offering expertise and active monitoring of the portfolio.

3. Accessibility: Investors can access markets and investment opportunities that might otherwise be unavailable or too expensive individually.

4. Economies of Scale: Lower transaction costs due to bulk investments.

5. Liquidity: Many pooled investment funds, such as mutual funds, offer easy entry and exit, making it simpler for investors to access their money.

2. Creating an Investment Portfolio as a Mutual Fund Manager Work

As a mutual fund manager work, the goal is to design and actively manage an investment portfolio that aligns with the fund’s objectives, adheres to regulatory requirements, and delivers optimal returns for investors. Below is a comprehensive guide to creating and managing an investment portfolio.

A. Define the Fund’s Objectives

Start by identifying the fund’s goals and mutual fund work, which guide all investment decisions:

1. Income Fund: Focus on stable returns through bonds and fixed-income securities.

2. Growth Fund: Aim for capital appreciation by investing in equities.

3. Balanced Fund: Combine equity and debt for a mix of growth and stability.

4. Thematic or Sectoral Fund: Invest in specific industries or themes.

5. Index Fund: Track and replicate the performance of a benchmark index.

B. Create an Asset Allocation Strategy

Allocate capital across asset classes based on the fund’s objective and market conditions:

1. Equity: Large-cap, mid-cap, small-cap, or sectoral stocks.

2. Debt: Bonds, treasury bills, or money market instruments.

3. Alternative Assets: Real estate, commodities, or derivatives (if permitted).

4. International Investments: Exposure to global markets for diversification.

3. Professional fund Management Work

Professional fund management involves the administration and oversight of investment funds by experts or firms who manage assets on behalf of individuals, institutions, or organizations. Fund managers are responsible for achieving the fund’s investment objectives while minimizing risks and adhering to regulatory requirements. Here’s an overview of how professional fund management works:

A. Process of Professional Fund Management

1. Fund Setup: The fund is worked with a prospectus detailing its objectives, strategy, fees, and other information.

2. Investor Pooling: Funds collect money from investors, issuing units or shares in return.

Investors own a proportional share of the pooled fund’s assets.

3. Asset Allocation: Allocate resources among various asset classes based on the strategy (e.g., 70% equity, 20% bonds, 10% cash).

4. Active Management: Fund managers work actively buy and sell securities to maximize returns.

Examples include identifying undervalued stocks or timing market cycles.

5. Ongoing Adjustments: Adjust positions as necessary due to market movements, macroeconomic shifts, or company performance changes.

6. Distributions to Investors: Earnings from the fund (e.g., dividends, interest, or capital gains) are distributed or reinvested based on the fund’s policy.

B. Roles in Fund Management

1. Portfolio Manager: Makes investment decisions, manages day-to-day operations of the fund, and ensures alignment with objectives.

2. Research Analyst: Conducts in-depth analysis of industries, companies, and economic trends to identify opportunities.

3. Risk Manager: Focuses on monitoring and controlling risks within the portfolio.

4. Trader: Executes buy and sell orders for securities based on the portfolio manager’s strategy.

5. Compliance Officer: Ensures the fund adheres to regulatory standards and internal policies.