The stock market refers to the collection of markets and exchanges where stocks (equity securities), bonds, and other securities are bought and sold. These markets are vital for the functioning of the global economy, as they provide companies with access to capital in exchange for giving investors a slice of ownership in the company.

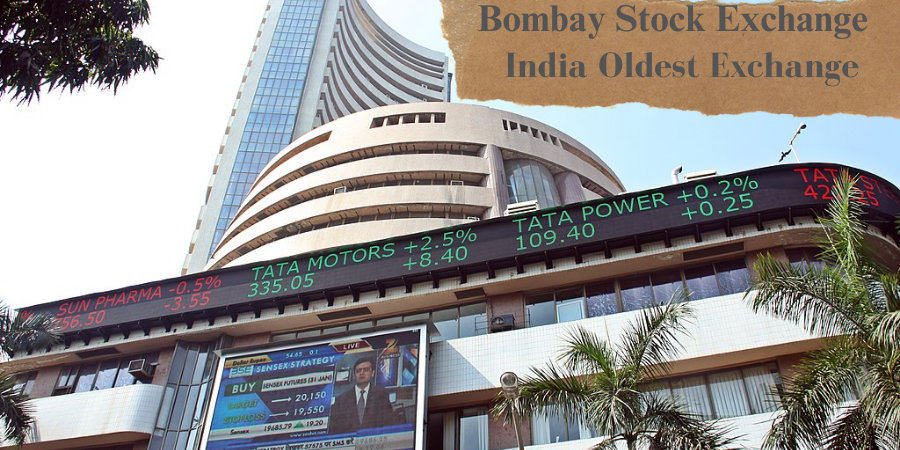

Bombay Stock Exchange

Introduction

Bombay Stock Exchange is oldest and most credible Exchange of India which is located in Mumbai. BSE is a hub for securities trading and has a significant role in the Indian financial markets. First Listed Stock: The first stock listed on the BSE was the Bombay Rice Mill. According 31 March 2024, 5505 company listed in BSE.

Functions and Roles

The BSE provides a platform for buying and selling securities like equities, bonds, mutual funds, derivatives, and more.

It serves as a barometer for the Indian economy, reflecting the performance of listed companies.

BSE Sensex

The BSE Sensex is represents the performance of 30 large, publicly traded companies listed on the BSE.

The Sensex is often used to gauge the health of the Indian stock market, much like the Dow Jones Industrial Average (DJIA) in the U.S. or the Nikkei 225 in Japan.

Trading Houre

The BSE operates from 9:15 AM to 3:30 PM (Indian Standard Time, IST) on weekdays, Monday to Friday.

There are also pre-market hours from 9:00 AM to 9:15 AM, during which orders are accumulated but not executed.

Types of Securities Traded

Equities: companies Share are listed on the exchange.

Bonds: List a many type of bund like government, corporate bond and Debt securities.

Derivatives: Futures and options contracts for various securities.

Exchange-Traded Funds (ETFs): Funds that are listed and traded on the exchange.

Market Segments

The BSE operates in different market segments, including:

BSE Main Board: For large-cap companies.

BSE SME: A platform for Small and Medium Enterprises (SMEs) to list and raise capital.

BSE Star MF: A platform for mutual fund distributors and investors.

BSE Debt Market: that is bond market and safe investment.

Globle connectivity

The BSE has international works with global exchanges and investors. It has also facilitated the introduction of cross-border trading.

It is a member of several international organizations, such as the World Federation of Exchanges (WFE).

Technological Advancement

The BSE uses advanced electronic trading systems. In fact, it was one of the first exchanges in India to introduce electronic trading in the 1990s, replacing the open outcry system (physical trading floor).

The BSE’s BOLT (BSE On-Line Trading) system is known for its speed and efficiency in processing transactions.

BSE Indexes

Apart from the Sensex, the BSE has several other important indexes:

BSE large cap: focuses large 100 company.

BSE Mid Cap: Focuses on mid-cap companies.

BSE SmallCap: Tracks smaller, more volatile companies.

Regulations and Governance

The BSE is regulated by SEBI, which ensures transparency, fairness, and protection of investors’ interests.

The BSE also adheres to global best practices in market conduct and disclosures, helping build investor confidence.

Investors Participance

Retail and institutional investors participate in the BSE, buying and selling stocks through brokers. Exchange is open domestic and international.

Foreign Institutional Investors (FIIs) have significant participation in the Indian stock markets, and their trading activity on the BSE influences market trends.

Recent Developments

The BSE has seen significant growth in recent years, driven by technological innovations and increased participation from retail investors.

It has also seen the introduction of new products and services, such as commodity derivatives, currency derivatives, and interest rate derivatives.

National Stock Exchange

Introduction

The National Stock Exchange of India (NSE) is one of the leading stock exchanges in India, and it plays a crucial role in the development and growth of India’s financial markets. Established in 1992, the NSE has become a major platform for trading in various securities, including equities, derivatives, and debt instruments. According 31 March 2024, 2379 company listed in NSE.

Function and Role

The NSE serves as a platform for trading various financial instruments like equities, derivatives (futures and options), bonds, and exchange-traded funds (ETFs).

The exchange offers capital-raising opportunities for companies through Initial Public Offerings (IPOs) and has facilitated liquidity for investors to buy and sell financial instruments.

Market Segment

Capital Market Segment: Deals with the trading of equity shares and debentures.

Derivative Segment: Allows trading in futures and options on stock indices, stocks, and other financial instruments.

Debt Market Segment: Facilitates the trading of government securities and corporate bonds.

Currency Derivatives: Provides a platform for trading in currency futures and options contracts.

Commodity Derivatives: Trading in futures contracts of commodities, such as gold, crude oil, and agricultural products.

Derivatives and Advanced Product

The NSE has a well-established derivatives market, including trading in stock futures, index futures, and options.

The Nifty Index Futures and Options are among the most popular derivatives products traded on the exchange, with significant daily volumes.

The NSE also offers other specialized products, such as interest rate futures, commodity derivatives, and currency derivatives.

International Reach

The NSE has attracted significant international interest and investment, particularly from Foreign Institutional Investors (FIIs).

It also partners with other global exchanges and financial institutions to expand its reach and product offerings.

Investments Strategies

If you meant “Investment Strategies,” this refers to the approach or method investors use to allocate their resources based on their financial goals, risk tolerance, and time horizon. Common strategies include:

A. Growth Investing:

Focus: Investor focus on heigh growth companies that are an above-average rate compared to other companies.

Goal: High returns through capital appreciation.

Risk: Higher risk, as the companies may not meet growth expectations.

B. Value Investing:

Focus: Invest in undervalued stocks that are selling below their intrinsic value. The idea is that the market has mispriced these stocks, and they will eventually be corrected.

Goal: Buy stocks for less than their true value and hold them until their price increases.

Risk: Risk of misjudging the intrinsic value and of holding onto underperforming stocks for too long.

C. Income Investing:

Focus: Invest in assets that generate steady income, such as dividends, interest, or rental income.

Goal: Provide regular income, especially for retirees or conservative investors.

Risk: Generally lower risk, but income streams may fluctuate based on market conditions.

D. Index Investing:

Focus: Invest in broad market indexes (like the S&P 500 or the Nifty 50) rather than individual stocks.

Goal: Index Investing is diversified stock so risk diversified with low risk.

Risk: Lower risk due to diversification, but returns are also limited to market performance.

E. Contrarian Investing:

Focus: Invest against prevailing market sentiment by buying when others are selling and selling when others are buying.

Goal: Profit from market overreactions or mispricing.

Risk: Risk of going against the market trends, but potential for high rewards if the market correction happens.

F. Dollar-Cost Averaging (DCA):

Goal: Reduce the impact of market volatility by averaging the purchase price over time.

Risk: Lower risk over the long term but may miss opportunities for higher returns during market upswings.

G. Socially Responsible or ESG Investing:

Focus: Invest in companies or funds that meet certain ethical, social, and environmental criteria.

Goal: Align investments with personal values while still aiming for financial returns.

Risk: Varies depending on the specific sector or companies chosen, but typically follows market trends.

Factors Influence of Stock Market

Several factors influence the stock market, which is a complex system driven by a combination of economic, political, social, and psychological elements. Here are the key factors that affect the stock market:

1. Economic Indicators :

Interest Rates: RBI and (like the Federal Reserve) adjust interest rates to control inflation and economic growth. When interest rates rise, borrowing becomes more expensive, which can lower consumer spending and business investment, leading to a potential drop in stock prices.Inflation: High inflation reduces the purchasing power of consumers and can lead to lower corporate profits, which may negatively affect stock prices. Low inflation is typically seen as beneficial for economic stability and stock growth.

Gross Domestic Product (GDP): Strong GDP growth usually signals a healthy economy, which tends to lead to higher stock prices. A slowdown or contraction in GDP growth can hurt investor confidence and result in lower stock prices.

Unemployment Rates: High unemployment can signal economic distress and lead to lower consumer spending, affecting corporate earnings and stock prices. Low unemployment typically reflects a strong economy and can have a positive effect on the stock market.

2. Corporate Earnings

Earnings Reports: Corporate profits are a major driver of stock prices. Strong earnings typically lead to rising stock prices, while weak earnings can result in stock price declines. Investors closely monitor quarterly earnings reports for signs of a company’s financial health.

Future Outlook: Investors also evaluate companies based on their expected future growth, which can be influenced by factors like product development, market demand, and competition.

3. Market Sentiment and Investor Psychology

Investor Sentiment: Market sentiment, which can be optimistic (bullish) or pessimistic (bearish), plays a significant role in stock price movements. News, rumors, and social media can create emotional reactions that influence buying and selling behavior.

Market Speculation: Speculative buying or selling (e.g., based on expectations of future performance or rumors) can lead to volatility in the stock market.

4. Political and Geopolitical Events

Government Policies: Government regulations, tax policies, and fiscal stimulus packages can impact business operations and investor behavior, which in turn affect stock markets.

Elections: Political elections can create uncertainty, and stock markets may react to potential policy shifts based on the party in power.

Geopolitical Events: Wars, natural disasters, trade tensions, or diplomatic crises can lead to market instability, as they can disrupt economic conditions and investor confidence.

5. Monetary Policy

Central Bank Actions: Central banks influence the economy by controlling money supply and interest rates. For example, quantitative easing (QE), where central banks inject money into the economy, can lead to higher liquidity, which might drive up stock prices. Tight monetary policy (e.g., raising interest rates or reducing money supply) can have the opposite effect.

6. Market Liquidity

Supply and Demand: The overall buying and selling activity in the stock market can affect prices. A high demand for stocks (more buyers than sellers) generally drives up prices, while an oversupply (more sellers than buyers) leads to price declines.

7. Technological Advancements

Innovation: Technological breakthroughs and advancements can create new industries, products, and markets, potentially boosting the stocks of companies that are at the forefront of these developments.

Automation and AI: The rise of artificial intelligence and automation can change industries, affecting stock prices for companies that successfully adopt these technologies or innovate around them.

8. Global Events

Global Economic Conditions: International trade relations, foreign economic growth or recession, and commodity prices (e.g., oil) can impact the performance of multinational companies and thus the stock market.

Currency Fluctuations: The strength of a nation’s currency can impact companies’ international profitability. For example, a stronger currency can reduce the competitiveness of exports, hurting the profits of export-dependent companies.

9. Speculation and Market Manipulation

Speculative Bubbles: Sometimes stock prices can become detached from the underlying fundamentals, driven by speculative buying or market hype. Eventually, these bubbles may burst, leading to sudden market corrections.

Market Manipulation: In some cases, stock prices can be influenced by large investors or groups engaging in activities like short selling, insider trading, or pump-and-dump schemes.

10. Supply Chain Issues and External Shocks

Pandemics or Natural Disasters: Events like the COVID-19 pandemic or natural disasters can disrupt global supply chains, economic activity, and consumer behavior, causing significant stock market volatility.

Supply Chain Disruptions: Problems in supply chains (e.g., shortages of raw materials) can hinder production and hurt company profits, affecting stock prices.

11. Sector-Specific Factors

Industry Trends: Stock prices can be heavily influenced by trends specific to certain industries. For example, changes in oil prices can affect energy stocks, while new regulations may impact the financial or tech sectors differently.

Regulatory Changes: New rules and regulations can have a significant impact on particular industries or companies. For example, stricter environmental regulations could negatively affect manufacturing companies.

In summary, the stock market is influenced by a wide range of factors, including economic data, corporate performance, investor sentiment, political events, and global developments. Stock prices often reflect a combination of these elements, making the market dynamic and subject to fluctuations.