What is SIP in Mutual Fund ? SIP (Systematic Investment Plan) in mutual funds is a disciplined way of investing a fixed amount regularly, typically on a monthly basis, into a specific mutual fund scheme. This investment strategy allows investors to accumulate wealth over time by investing a small amount consistently rather than making a lump sum investment.

Full Detailed Analysis Best Mutual Fund SIP, Best Mutual Fund for SIP Investment & What is SIP in Mutual Fund ?

1. Discipline in Mutual Fund SIP Investing

Discipline in mutual fund SIP (Systematic Investment Plan) investing is crucial for success. this is regular fix amount investing as per market conditions. This strategy helps average the cost of investments, mitigates the impact of market volatility, and fosters a long-term investment mindset.

Key aspects of maintaining discipline in SIP investing include:

A. Setting Clear Financial Goals: Knowing what you aim to achieve with your investments helps maintain focus.

B. Sticking to the Investment Plan: Consistency is vital; continue investing as planned, even during market fluctuations.

C. Avoiding Emotional Decision-Making: Resist the urge to make impulsive decisions based on market emotions.

2. Rupee Cost Averaging in Mutual Fund SIP

Rupee cost averaging is a basic concept in mutual fund Systematic Investment Plan investing that is fundamental of mutual fund. It refers to the strategy of investing a fixed sum of money at regular intervals, regardless of the share price at that time.

1. How to work rupee cost averaging in Mutual Fund SIP

A. Regular Investment: An investor commits to investing a specific amount, say ₹1,000, every month.

B. Fluctuating Prices: The market price keeps fluctuating so our risk and reward remains managed in these SIP.

C. Average Cost: Over time, this results in acquiring units at various price points, which averages out the cost of each unit.

2. Benefits of Rupee Cost Averaging in Mutual Fund SIP

A. Mitigates Market Volatility: It reduces the impact of market fluctuations since the investor purchases more units when prices are low and fewer when prices are high.

B. Disciplined Investing: Encourages regular investing habits and mitigates the temptation to time the market.

C. Lower Average Cost: When is fluctuate, the average cost per unit can be lower compared to a lump sum investment at a high market price than risk is minimize in SIP.

3. Power of Compounding in Mutual Fund SIP

The power of compounding in mutual fund SIP (Systematic Investment Plan) investing refers to the process of earning returns on both the initial investment and the returns that accumulate over time.

1. How Compounding Works Mutual Fund in SIP

A. Investment Growth: When you invest in a mutual fund via SIP, your money is continually growing. The returns generated on your investments are reinvested, leading to further growth.

B. Time Factor: The longer you stay invested, the more pronounced the effects of compounding become.

2. Benefits of Mutual Fund Compounding in SIP

A. Wealth Creation: Over long periods, compounded returns can significantly increase the value of your investment. The earlier you start investing, the greater the impact will be.

B. Inflation Hedge: Compounding helps your investments grow at a rate that can outpace inflation, preserving purchasing power.

Less Pressure on Monthly Contributions: As your investment grows, you may not need to increase your monthly contributions as dramatically to achieve your financial goals.

4. Flexibility in Mutual Fund SIP

A Systematic Investment Plan (SIP) for mutual funds offers considerable flexibility, making it an attractive option for investors. Here are some key aspects of flexibility in mutual fund SIPs.

A. Customizable Investment Amount: SIPs allow you to invest as per your budget, with amounts as low as ₹100 or ₹500 in many cases.

You can increase or decrease your SIP amount using options like SIP Top-Up or Step-Up SIPs, which adjust your contribution over time.

B. Choice of Frequency: SIPs offer various investment frequencies, such as monthly, quarterly, or weekly, allowing you to align contributions with your cash flow or salary cycle.

C. Pause or Skip SIPs: Many fund houses allow you to temporarily pause your SIP for a specific duration in case of financial difficulties, without having to terminate the plan.

D. Start, Stop, or Modify SIPs Anytime: SIPs can be started online or offline at your convenience.

If your financial priorities change, you can any time stop or start and modified without any penalties.

E. Top-Up SIP Option: Some mutual funds offer the ability to periodically increase your SIP amount automatically, helping you align with rising income levels or inflation.

F. Partial Withdrawal Facility: You can redeem part of your investments while continuing the SIP.

G. Flexi SIPs: Certain mutual funds offer Flexi SIP options where you can change the contribution amount for a specific installment, providing additional liquidity control.

H. No Commitment to Long Tenure: While SIPs are usually associated with long-term investing, you’re not locked into a fixed tenure and can stop investing anytime.

5. Tax Benefit in Mutual Fund SIP

Investing in a Systematic Investment Plan (SIP) can offer tax benefits, especially if you choose the right type of mutual fund. Here are some key points:

A. Equity Linked Savings Scheme (ELSS): SIPs in ELSS mutual funds are eligible for tax deductions under Section 80C of the Income Tax Act. You can claim a deduction of up to ₹1.5 lakh per year2.

B. Tax-Free Returns: The returns from ELSS funds are tax-free up to ₹1 lakh per year. Any gains above this amount are taxed at 10%.

C. Long-Term Capital Gains: For equity funds, if the investment is held for more than 12 months, the gains are considered long-term and are taxed at 10% for amounts exceeding ₹1 lakh2.

D. Short-Term Capital Gains: If the investment is held for less than 12 months, the gains are considered short-term and are taxed at 15%.

6. How to Invest in Best Mutual Fund SIP

Investing in the best mutual fund full information and analysis step to step here.

A. Identify Your Goals: Determine your investment objectives, such as saving for retirement, buying a house, or funding education. Your goals will help you choose the right type of mutual fund2.

B. Assess Risk Tolerance: Understand your risk appetite. Equity funds are high-risk tolerance, while debt funds are better for conservative investors.

C. Investment Horizon: Match your investment horizon with the appropriate fund type. For short-term investment can consider debt funds. For medium-term investment (3-5 years), hybrid funds are suitable. For long-term investment can consider (5+ years), equity funds.

D. Research Fund Performance: Look at the historical performance of the funds, but remember that past performance is not always indicative of future results. Check the fund’s consistency and performance during different market conditions2.

E. Expense Ratio: Consider the expense ratio, which is the annual fee charged by the fund. Lower expense ratios contribute your higher net returns.

7. Factors to consider before investing mutual fund SIP in 2025

Investing in a mutual fund SIP in 2025 requires careful consideration of several factors to ensure you make informed decisions. Here are detailed information for mutual fund investing in 2025.

A. Financial Goals: Clearly define your financial goals and investment horizon. Whether it’s saving for retirement, buying a house, or funding education, your goals will guide your investment choices.

B. Fund Performance: Evaluate the historical performance of the mutual funds. Look for consistency and performance during different market conditions.

C. Expense Ratio: Consider the expense ratio, which is the annual fee charged by the fund.

D. Fund Manager’s Track Record: Check the experience and track record of the fund manager that is very important analysis for investing.

E. Diversification: Ensure the fund offers diversification across different sectors and asset classes to minimize risk.

F. Market Trends: Market trend knowledge can significant role play. Factors like interest rates, inflation, and geopolitical events can impact your investments.

G. Regulatory Changes: Be aware of any regulatory changes that might affect mutual fund investments. Keeping up with SEBI guidelines and other regulatory bodies is crucial.

H. Technology and Digital Platforms: Leverage technology and digital platforms for easier management and tracking of your investments.

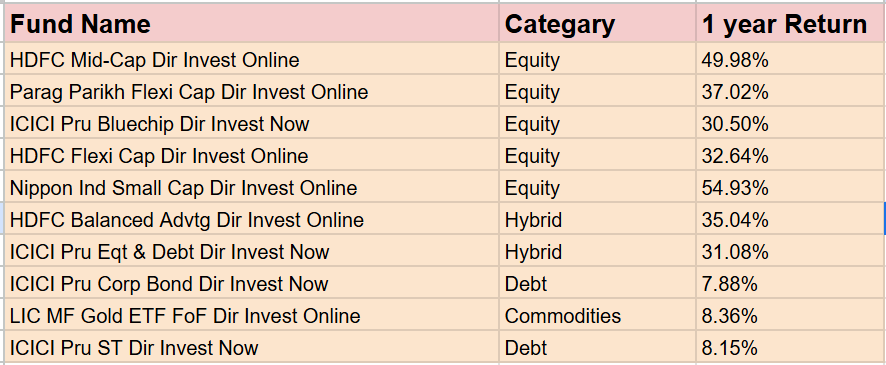

8. Top 10 Best Mutual Fund SIP Return